owner's draw vs salary

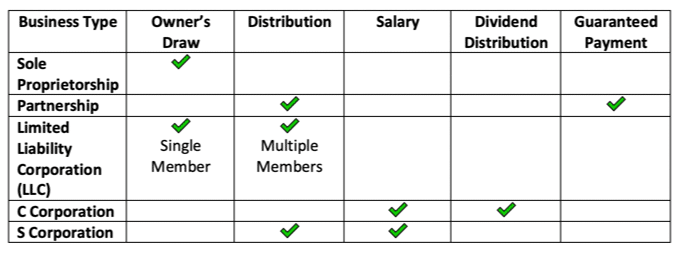

Before you can decide which method is best for you you need to understand the basics. Heres a high-level look at the.

Should I Pay Myself With A Salary Or Owner S Draw My Vao

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

. There are positive and negative aspects to both of these methods. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. Owners equity refers to your share of your business assets like your initial investment and any profits your business has made.

An owners draw is very flexible. You dont need a salary because you. Your two payment options are the owners draw method and the salary method.

An owners draw refers to an owner taking funds out of the business for personal use. Draws can tie directly to the companys performance. On the other hand a.

Likewise if youre an owner of a sole proprietorship youre considered self-employed so you wouldnt be paid a salary but instead take an owners draw. The owners draw method offers a greater level of flexibility than the salary method. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses.

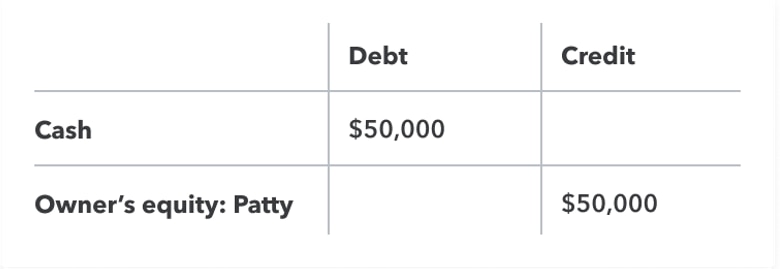

Thus an owners draw is the way an owner pays himself rather than taking a salary from the business. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. An owners draw refers to an owner taking funds out of the business for personal use.

For example if you invested 50000 into. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Pros and Cons of Owners Draw vs.

Understand the difference between salary vs. What is an owners draw. Also you can deduct your pay from.

Also any business profits that arent paid out as salary or an owners draw will be taxed at the corporate tax rate instead of the personal income tax rate for sole proprietors and. Pros and Cons of Owners Draw and Salary. In the former you draw money from your business as and when you see fit.

On the other hand a. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Many small business owners compensate themselves using a draw rather than paying.

Owners draws can be scheduled at regular intervals or taken only. Many small business owners compensate themselves using a. Suppose the owner draws 20000 then the.

The funds drawn out of the business must be taken out of the business.

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

How To Pay Yourself As A Business Owner Smallbizgenius

How To Pay Yourself From Your Small Business Legalzoom

Self Employed Payroll Is It The Right One For You Reliabills

Blog C Corporation Taxes And Self Payment

Comparing Salary Vs Hourly Vs Commission Employees Which Is Better For Your Business

Salary Vs Owner S Draw Getting Paid As A Small Business Owner

How To Pay Yourself As A Business Owner Youtube

Pay Yourself Right Owner S Draw Vs Salary Onpay

Salary For Small Business Owners How To Pay Yourself Which Method Owner S Draw Vs Salary Youtube

Owner S Draw Vs Salary What Is An Owner S Draw Nav

:max_bytes(150000):strip_icc()/DrawingAccount-41ee72f0f43f4947981bbeac838a3008.jpg)

Drawing Account What It Is And How It Works

This Is How Much To Pay Yourself As A Business Owner

How To Pay Yourself As A Business Owner Article

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

The Right Ratio Between Salary And Distribution To Save On Taxes

Does An Owner Draw Count As Salary For The Paycheck Protection Program Ppp Nav

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)